When tax season comes around, one of the primary goals for many taxpayers is to minimize their tax liability as much as possible. A key strategy for achieving this is to maximize deductions. Deductions are valuable as they directly reduce your taxable income, potentially leading to a lower tax bill or even a refund. For most individuals, the W2 form plays a crucial role in claiming various deductions. In this article, we will explore how your W2 form can be utilized to maximize deductions and reduce your tax burden.

Understanding the W2 Form

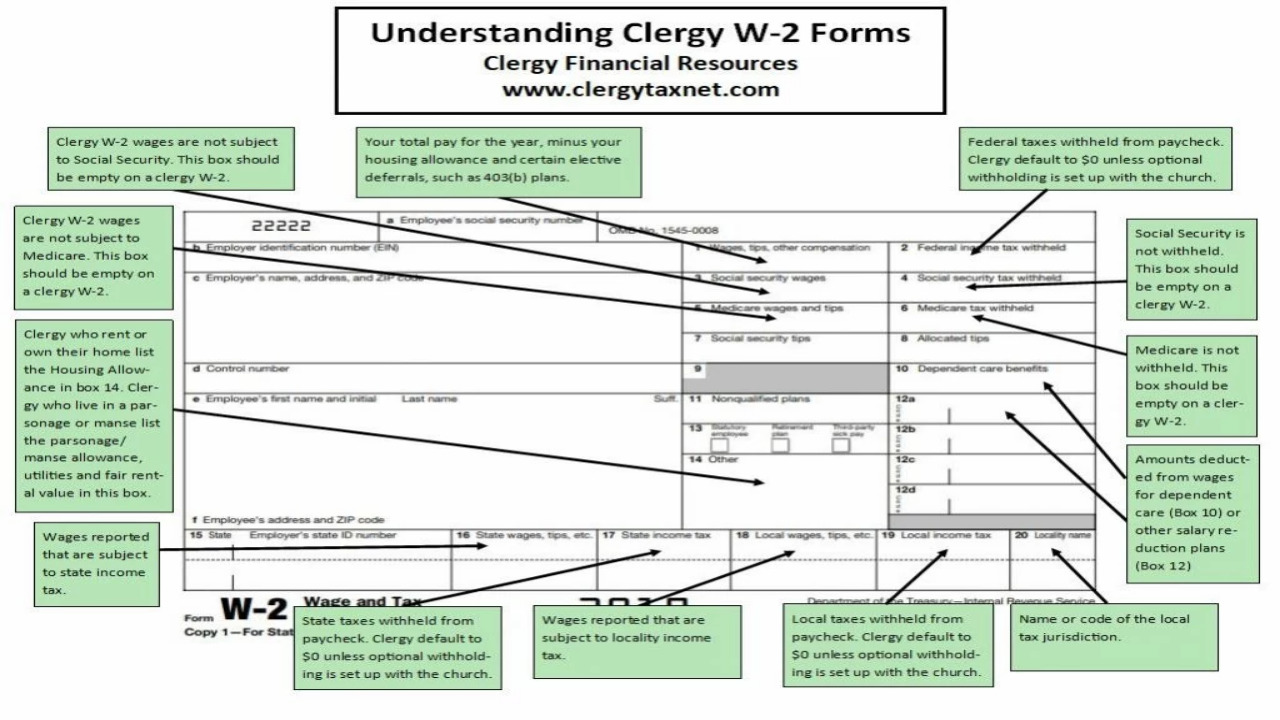

The W2 form is a document provided by employers to their employees, summarizing their annual earnings and taxes withheld during the tax year. It includes essential information such as wages, salary, tips, bonuses, and various contributions to retirement accounts and healthcare plans. Understanding the components of the W2 form is crucial in identifying deductions you may be eligible for. Did you know that you can create W-2 forms online? Learn how on paystubs.net!

Employee Business Expenses

If your job requires you to spend money on work-related expenses that are not reimbursed by your employer, you may be eligible to deduct these expenses on your tax return. However, the rules for employee business expenses have changed in recent years. As of my last knowledge update in September 2021, the Tax Cuts and Jobs Act (TCJA) eliminated the deduction for unreimbursed employee business expenses for most taxpayers. But some exceptions may still apply for specific professions or circumstances, so it’s essential to consult a tax professional or refer to the latest tax laws.

Retirement Contributions

Contributions made to retirement accounts, such as a 401(k) or traditional IRA, can significantly reduce your taxable income. Your W2 form should reflect the amount contributed to these accounts throughout the tax year. The contributions are typically listed in Box 12 with the code “D” for 401(k) contributions or “E” for traditional IRA contributions. By contributing to these accounts, you not only secure your financial future but also potentially lower your tax liability.

Healthcare Contributions

If you have a Health Savings Account (HSA) or a Flexible Spending Account (FSA) through your employer, the contributions made to these accounts are generally not subject to federal income tax. The amounts contributed to these accounts should be reported in Box 12 of your W2 form with the codes “W” for HSA contributions and “F” for FSA contributions. Taking advantage of these accounts allows you to set aside pre-tax money for medical expenses, thus reducing your taxable income.

Educational Assistance

Some employers offer educational assistance programs to their employees, which can be a valuable benefit. If you received educational assistance from your employer during the tax year, it might be excludable from your taxable income up to a certain limit. Look for Box 12 of your W2 form with the code “T” to identify any educational assistance provided to you.

Childcare Benefits

If your employer provides childcare benefits, such as a Dependent Care Assistance Program (DCAP), the amount of benefits received may not be subject to federal income tax. These benefits are listed in Box 10 of your W2 form. Utilizing such benefits can significantly reduce your taxable income, helping you save on taxes.

Consult a Tax Professional

While maximizing deductions using your W2 form can be beneficial, tax laws are complex and subject to change. It is crucial to consult a qualified tax professional or use reputable tax preparation software to ensure you claim all eligible deductions correctly. Remember to keep accurate records of your expenses and contributions throughout the year, as this will make tax preparation smoother and more efficient.

In conclusion, your W2 form holds valuable information that can help you maximize deductions and lower your tax liability. From retirement contributions to healthcare benefits, understanding the components of your W2 form allows you to take advantage of available deductions and keep more of your hard-earned money. Always stay informed about the latest tax laws and seek professional advice when needed to make the most of your tax-saving opportunities.