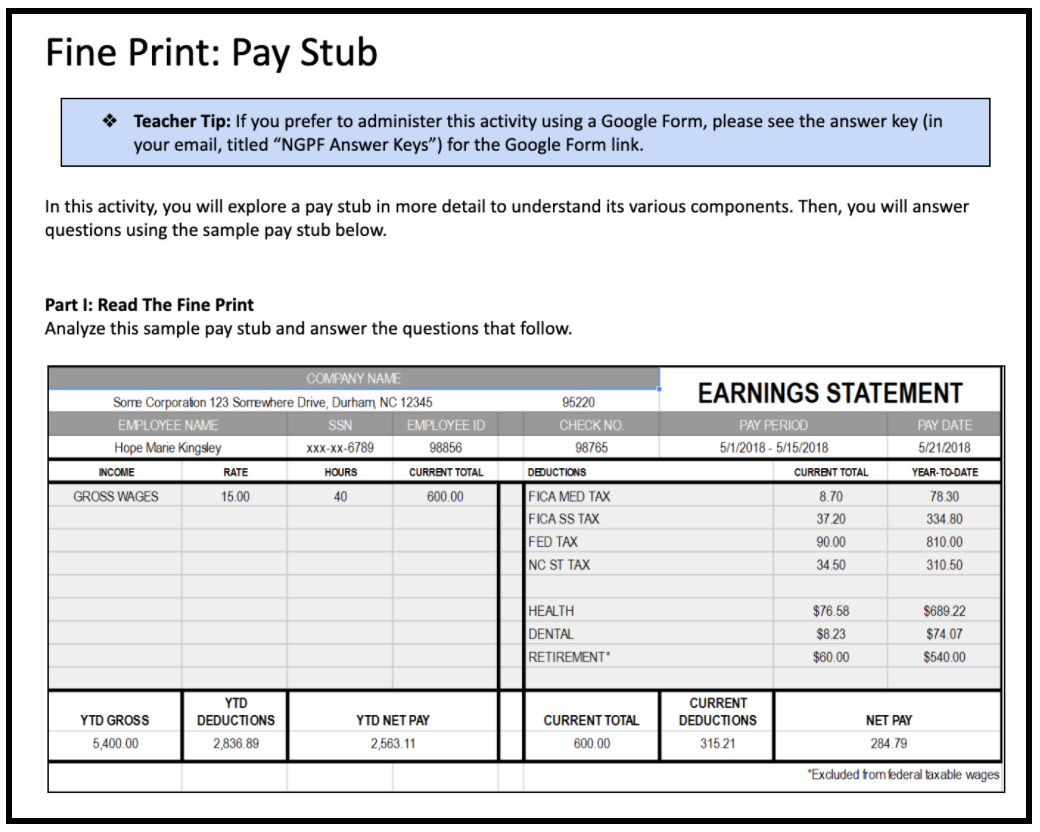

In the realm of personal finance, creditworthiness plays a pivotal role in determining an individual’s borrowing capacity. Lenders scrutinize various financial factors before granting a loan, and one of the critical documents they rely on is the pay stub. A pay stub is a record of an employee’s earnings and deductions, offering valuable insights into an individual’s financial stability and ability to repay debts. This article delves into how pay stubs impact borrowing capacity and provides five essential tips to improve creditworthiness.

Understanding the Significance of Pay Stubs

A pay stub generator provides comprehensive details about an individual’s income, taxes, deductions, and contributions to various benefits and retirement plans. Lenders use this information to assess an applicant’s financial standing, determine their debt-to-income ratio, and evaluate their capacity to take on additional debt. A favorable debt-to-income ratio, which indicates a stable income compared to existing debts, is crucial for securing loans with favorable terms and interest rates.

Maintaining Consistent Income

Consistency in income is a vital aspect that lenders look for in pay stubs. A stable employment history and a steady stream of income signal financial responsibility and increase the likelihood of loan approval. To improve creditworthiness, individuals should aim to sustain steady employment or income sources and avoid frequent job-hopping or periods of unemployment.

Minimizing Debt-to-Income Ratio

As mentioned earlier, the debt-to-income (DTI) ratio is a key metric in determining borrowing capacity. It is calculated by dividing an individual’s monthly debt payments by their gross monthly income. Lowering this ratio by reducing debts or increasing income can significantly enhance creditworthiness. Individuals should focus on paying off outstanding debts, avoiding unnecessary credit utilization, and steering clear of maxing out credit cards.

Documenting Additional Income Sources

In some cases, individuals may have supplementary income sources beyond their primary employment, such as rental income or freelance earnings. It is crucial to document these additional income streams with proper documentation, as they can positively impact the borrower’s overall creditworthiness. Providing evidence of diversified income can make lenders more confident about a borrower’s ability to handle financial responsibilities.

Timely Payment of Bills and Debts

Perhaps one of the most critical factors affecting creditworthiness is the track record of timely payments. Lenders scrutinize credit reports to assess an applicant’s credit history, including the promptness of bill payments and debt settlements. Consistently paying bills on time and avoiding defaults can significantly improve credit scores, leading to increased borrowing capacity and better loan terms.

Conclusion

In conclusion, pay stubs play a crucial role in determining an individual’s borrowing capacity and creditworthiness. Lenders rely on this document to assess an applicant’s income stability, debt-to-income ratio, and overall financial responsibility. To enhance creditworthiness and improve borrowing capacity, individuals should maintain consistent income, minimize their debt-to-income ratio, document additional income sources, and prioritize timely payments of bills and debts. By following these essential tips, individuals can bolster their financial standing and secure better opportunities for borrowing in the future. Responsible financial management, coupled with a strong credit profile, empowers individuals to achieve their goals and aspirations without undue financial stress.